It’s impossible to fully grasp how robotics is changing manufacturing in the United States without a complete understanding of where those robots are. Now, new research is providing a snapshot.

And here’s why that’s important: Robotics is what’s known as a general-purpose technology—just like computers, the internet, and electricity—that has the potential to make a fundamental difference in how entire economies operate. In short, robots present an opportunity to transform the manufacturing industry to reach new levels of productivity and growth.

But the first step in maximizing that potential is understanding how the technology is used. “We’re still in the early stages of understanding what’s driving robot adoption,” said Erik Brynjolfsson, director of the Stanford Digital Economy Lab and senior fellow at the Stanford Institute for Human-Centered AI (HAI). “It’s important to have data about where they are and also where they aren’t, and what their other characteristics are.”

Finding the robot hubs

Brynjolfsson is the co-author of a new paper on robotics adoption, along with researchers J. Frank Li, Cathy Buffington, Nathan Goldschlag, Javier Miranda, and Robert Seamans. In “The Characteristics and Geographic Distribution of Robot Hubs in US Manufacturing Establishments,” the team sourced responses from the US Census Bureau’s Annual Survey of Manufacturers to examine which manufacturers use robotics, where the robots are, and how establishments are using them. (A shorter version of the paper, “Robot Hubs: The Skewed Distribution of Robots in US Manufacturing,” is published in AEA Papers and Proceedings 2023.)

“Before we answer all those other questions about productivity and performance and wages, you need to know where the robots are first,” Brynjolfsson said. “For now, the striking finding was how concentrated the robots are.”

More than any other factor, the researchers found that a business is more likely to employ robotics if other establishments in its region report they also use them. In the paper, these concentrated regions of robotics use are called “robot hubs.”

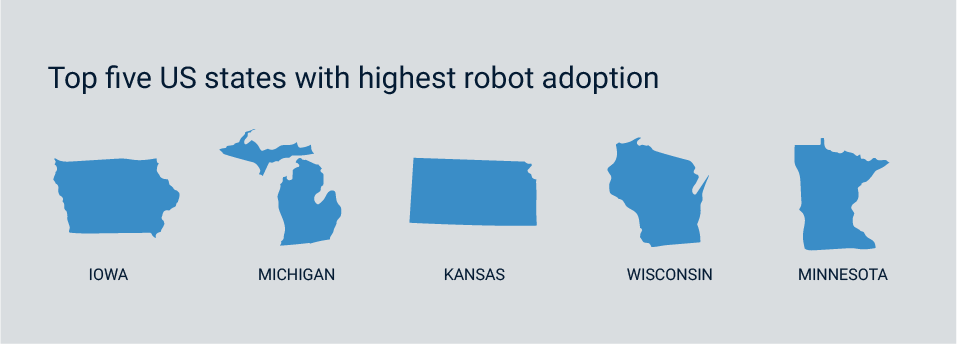

The team ranked regions by the number of robots used in manufacturing, which revealed that robots are highly concentrated in the top 10% of robot-dense areas—and the bottom 50% of regions had almost none. Survey data showed that the top five states with the highest robot adoption share by establishments were Iowa, Michigan, Kansas, Wisconsin, and Minnesota.

The paper also identifies several trends associated with robot hubs, including the presence of “robot integrators,” which are businesses that assist in acquiring and installing robots. Another correlation was a higher share of union membership. Those patterns on their own, however, don’t fully illuminate why a robot hub develops.

“The concentration of robot hubs is a function of several different things, such as the type of manufacturing these firms do, the education of the workforce, the size of the establishments, but it’s also sort of an unexplained dark matter, and that seems important as well,” Brynjolfsson explained. “Something about these environments makes it so that companies are more likely to use robots. A big part of future research will be to find out why that is.”

The advantage of census data

Past attempts to generate insight into robot adoption faced challenges, such as selection bias, inherent to the research process. For example, if researchers mailed out surveys or called manufacturers directly, potential respondents might not have picked up the phone. Or a manufacturer might assume that the survey had nothing to do with them and not mail their response back.

Of course, that assumption would be wrong. To fully and accurately understand the spread of robotics throughout the manufacturing industry, it’s vital to get accurate input from a representative set of establishments.

“There’s never been any careful data gathering on where robots are in America,” said J. Frank Li, a postdoctoral fellow at the Stanford Digital Economy Lab and one of the study’s authors. “There have been plenty of different kinds of bits and pieces that people gathered, but now for the first time, we worked with the US Census to gather some really detailed data on where robots actually are.”

In addition to counting people, the US Census Bureau conducts regular studies into trends and demographics throughout the economy. The Annual Survey of Manufacturers (ASM) was one of these—a set of questions designed to understand the current state of the manufacturing industry across several dimensions.

Since responding to the ASM is a legal requirement, responses don’t suffer from the same selection bias as non-mandatory surveys do. This enabled the team to gain unprecedented insight into the use of robots, confident that responses accurately reflected the nature of the entire manufacturing industry. The researchers developed their questions in 2017, which were included in the surveys for 2018–2020. The findings in the paper are based on 2018 data.

Brynjolfsson noted that he was impressed by the bureau’s process in developing the survey. “When a survey is required by law, you don’t want it to be cluttered up with anything time-wasting, so they did over a year of testing,” he said. “That process was an eye-opener for me, and I think it led to a survey that’s far and away the most representative of the industry, thanks to the Census. Otherwise, the data would have been way too scattered.”

Director, Stanford Digital Economy Lab

Laying the foundation

The researchers’ findings weren’t limited to solely identifying robot hubs, though. Data from the ASM also included information on the size and age of surveyed establishments and their workforces.

From this data, the researchers found that higher robotics use correlated with higher capital expenditures, particularly in information technology. The research suggests that companies willing to pay the price for robots are also more likely to spend more on other innovations and improvements, leading to enhanced automation and digitalization.

That kind of investment creates a spillover effect throughout surrounding local economies, just like the manufacturing output of the robots does. If the use and integration of robots creates better economic outcomes, then a stark divide between robot hubs and everywhere else could challenge overall growth.

Brynjolfsson raises this possible divide as a legitimate concern. “Having robots so concentrated could lead to a separation, where some manufacturing becomes much more high-tech and robust, and other parts get left behind—so it’s valuable to understand what drives the adoption and, ultimately, the diffusion of robots,” he said. “If we want not just productivity, but widely shared productivity, we need to have robots in places where right now they’re not as common.”

Understanding why companies are adopting robots in certain areas and not others will help guide future development throughout the manufacturing industry. Researchers, data agencies, policymakers, and industry stakeholders can all leverage the paper’s insights to work toward a more balanced and inclusive deployment of robotics.

The research team realizes that their work is just the beginning of a long line of research into understanding the impact of robotics in manufacturing. The authors propose several avenues that future researchers could pursue—one looks into the relationship between robot hubs and international trade, while another explores the link between robot adoption and other investments. “Our hope is that the patterns in the data that we document in our paper spark further research in this area that is of use to scholars, practitioners, and policymakers,” the researchers wrote.

Future researchers can also better understand the advantages and obstacles of robotics in manufacturing by examining the influence of robots on productivity and wages in manufacturing establishments. A more collaborative environment will make it easier to enable economic growth and tech advancement in the manufacturing sector—and beyond.

“Our examination of the cross-sectional data indicates that robot adoption is positively associated with the share of production workers but negatively associated with earnings per worker,” said Li. “However, what we can say about causality and the mechanism behind our findings is still limited without longitudinal data and exogenous shocks. I expect that as new waves of survey data become accessible, there will be an increase in research exploring the impact of robots on the US manufacturing sector.”

Any opinions and conclusions expressed herein are those of the authors and do not represent the views of the U.S. Census Bureau. Disclosure review numbers CBDRB-FY22-ESMD011-003, CBDRB-FY23-ESMD011-003, CBDRB-FY22-192, and CBDRB-FY23-ESMD011-004 (DMS# 7508509). We are grateful to the Hewlett Foundation, Kauffman Foundation, National Science Foundation, Stanford Digital Economy Lab and Tides Foundation for generous funding. We thank Jim Bessen, participants at the 2023 AEA Annual Meeting, and Emin Dinlersoz for valuable comments and feedback. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

The authors are grateful to the Hewlett Foundation, Kauffman Foundation, Markle Foundation, National Science Foundation, Stanford Digital Economy Lab, and Tides Foundation for generous funding.